Background

Kaus has 30 years of experience in the industry, so knows the product well. They enter a market with stiff competition, but they are willing to try to innovate approaches to capture customers. They are prioritizing user experience to differentiate from competitors. They want to focus on younger consumers.

The Problem

WHAT THE CLIENT NEEDS TO CHANGE

Kaus wants to move from B2B sales of their insurance products to direct to consumer sales.

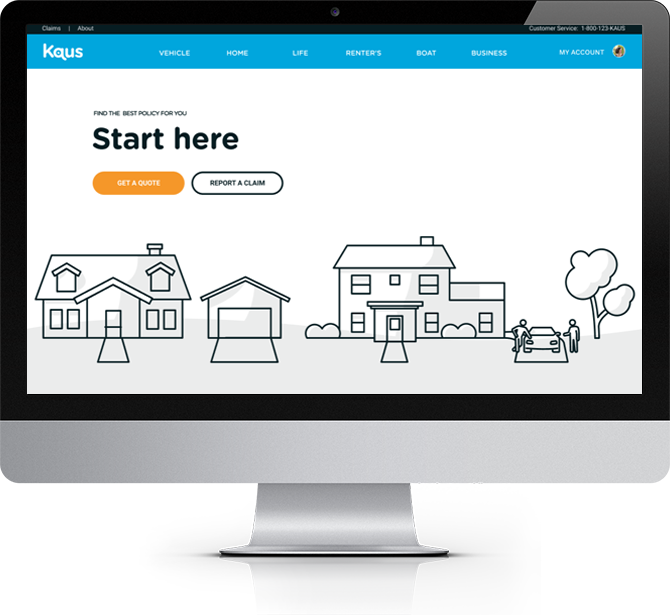

Design a new modern website and fresh logo for the company.

Design a responsive e-commerce website that is pleasing to use and that allows customers to browse through all products and easily filter by relevant data.

Hypothesis

POINT OF VIEW TO BE PROVED OR DISPROVED

Young people (ages 18-34) are equally interested in all types of insurance policies offered.

Young people (18-34) are more interested in bundle packages than customized packages.

Young People (18-34) are the only age group using internet, personal devices to buy/research insurance and therefore a rebranded look will attract them and help the company catch up.

Research Goal

WHAT WE HOPE TO ACCOMPLISH

We want to know how young people make decisions using digital technology about insurance so that they attain a growing digital market share.

Research Objectives

HOW WE WILL GET THERE

Through research, we hope to understand all digital users and how they make decisions regarding insurance.

MY ROLE

- UX Researcher

- UX/ UI Design

- Branding

TOOLS USED

- Figma

- Adobe Illustrator

- Miro

DURATION

- 80 Hours

01

EMPATHIZE

02

DEFINE

03

IDEATE

04

PROTOTYPE

05

TEST

01

EMPATHIZE

Interviews

User Interview Reasoning

THE APPROACH

- Conduct firsthand interviews with young people who have purchased insurance

THE REASONING

- It will provide knowledge of the interests and concerns of the focus demographic

Interviews

SME Interview Reasoning

THE APPROACH

- Conduct SME’s with a professional Insurance Agent

THE REASONING

- Understand the experience of dealing with young users (18-34), the services they tend to be interested in, and whether the bundle offerings make the most sense.

FINDINGS

Despite stage of life, 73% of users interviewed got two or more quotes before making a purchase decision.

INSIGHTS

Help user’s feel empowered: they are in control of their decisions on how to spend their money and what’s best for them.

DESIGN DECISION

Offer the users 3 quotes at the same time at varying levels of price and coverage while also incorporating other ways to save.

FINDINGS

The claim process is super important to customers and a bad experience can cause users to change providers.

INSIGHTS

Allow users to file a claim online or via phone with an agent. Where and how to do this needs to be obvious, simple, and fast.

DESIGN DECISION

Place on the homepage in a prominent spot with clear words “File a Claim” and use an icon to help communicate the message.

FINDINGS

Users want the quote process to be fast, simple, and not difficult to understand. They also want to trust the process.

INSIGHTS

Communicate to users the time it takes to get a quote. Users trust online reviews as much as word of mouth.

DESIGN DECISION

Post a video link – how to get a quote and state the time it takes. Show reviews from other customers to help build trust.

FINDINGS

The stage of life the user is in, greatly affects the type of insurance products the user is interested in.

INSIGHTS

Users might be swayed into additional purchases if they physically see the pricing and the coverages for other options

DESIGN DECISION

Show three-tiered pricing with some information grayed out (unavailable for that quote).

02

DEFINE

Empathy Map

My Process: Upon creating personas, an empathy map was created to get a sense of what they user is doing (on a typical day), thinking and feeling (what’s important to them), seeing (in their environment), hearing (what influences them), their pains (what challenges they have) and their gains (hope to achieve and or measure success).

Card Sorting

Objective: To understand how users fit content into an existing structure. The results will be analyzed to help create an experience that is simple and easy to use.

Findings: All participants grouped a few of the same cards together in regards to insurance types, claims, and quotes. There were major differences in the grouping of the quick links as well as things to do under sign-in.

03

IDEATE

Sketches

My Process: I did several rounds of sketches and annotated them.

Sample Findings:

- Have minimal distractions to minimize friction/ funnel attention

- Reinforce user concerns on the quick links

- Use line art to appear fun, friendly, and approachable

- Validate user concerns with reviews – users treat online reviews as if coming from a friend.

Wireframes

My Process: Wireframes were created for the insurance purchase flow. Annotations were added calling out some considerations and/or decisions that were informed by research. Some breakpoints were identified for the responsive design process that gives a consistent flow and user experience despite the device. Consistent grid sizing was used to help further give consistent experience.

Research Driven Insights:

- Addition of customer reviews to help influence decisions

- Show a video on how to get a quote and how much time it takes

- Secondary tasks and needs

- Validation of lender information

Brand Colors

Rationale: Colors play an important role in how your brand is perceived. In color psychology, the color blue is associated with “trust.” For insurance, trust is an important aspect.

PMS colors were chosen for the main brand colors to allow flexibility for Branding and print purposes. A blue and teal scheme helps appear feminine yet masculine.

04

PROTOTYPE

Figma Prototype

My Process: The prototype will be used for usability testing and sharing with the stakeholders.

05

TEST

Usability Testing Plan

My Process: A usability test plan was created with an an introduction, script, and pre-planned scenarios and follow up questions.

Participants were recruited to test the usability of the prototypes.

The users were given three scenarios. The sessions were recorded and notes were taken on the actions of the participants.

Affinity Map

My Process: I organized the notes, comments, and feedback from the usability tests into an affinity map with 4 sections: Suggestions, Success, Patterns, and Confusion/ Frustration. These notes help understand the users’ experience and where and how the design can be refined.

I then prioritized the iterations and proceeded to make iterations.

Iterations

Finding: The users felt the icon headers didn’t tell them where to go.

Insight: While the headings were concise, they didn’t speak to the users’ needs.

Design Decision: The titles for the headers were changed to speak to user needs. The policy was changed to higher priority need of printing ID cards

Iterations

Finding: Users wanted the ability to save a quote and get back to it. They also wanted clearer options to start over or go back. The “My Quote” title also didn’t highlight the comparison aspect.

Insight: The users missed out on some extra features and functionality they thought would be helpful in using the site.

Design Decision: I changed the header wording to “Compare your quotes”, and added a “Back and “Start Over” button as well as an ability to save a quote.

Conclusion

Insights: Users want to get what they need and be able to do it fast and easily.

Challenges: Insurance involves asking lots of questions and information and then allowing users to see compare that information at the same time to make a decision.

What I learned: Break things down into simple steps so as to not overwhelm the user.

What could I have done differently: Explore the options to expand and hide details of the quote to allow the user to see the price and get the details if they want.

What next steps would you take to further improve the project: Further testing the home page post changes made at the usability test.

Key Takeaways: Allow the user to edit or start over just in case they wanted to make changes.

What am I most proud of: The idea to simplify the questions one at a time and making the next button inactive until they answer the question.